Should you accept Cryptocurrency in your online store

Have you ever thought of accepting cryptocurrency as payment? Do you know many multinational corporations now accept payment in cryptocurrencies? In this blog, we will look at who accepts cryptocurrency as payment, how cryptocurrency is becoming more widely accepted, and how crypto payment is settled.

Who Accepts Crypto

A lot of multinational corporations from a wide range of industries are now accepting crypto as payment. Just a few examples:

● Microsoft (software)

● Whole Foods (retail)

● Expedia (travel)

● Burger King Venezuela (F&B)

● Twitch (gaming)

● Wikipedia (online media)

● ExpressVPN (VPN)

If this list does not surprise you, this might: colleges like King’s College in New York City, ESMT Berlin, University of Cumbria and University of Nicosia have decided to accept Bitcoin payments for tuition fees. The spokesperson at University of Nicosia said,

“The intention of this initiative is to ease transmission difficulties for certain students and to build our own practical knowledge about this field, not to engage in currency speculation[1].”

This suggests that digital currencies have created more efficient services by cutting transaction time and cost, as well as served as a mechanism for spreading financial services to under-banked regions of the world. Regarding the use of cryptocurrencies, Eric Lockard, corporate vice president of Universal Store at Microsoft, commented in 2014,

“For us, this is about giving people options

and helping them do more on their

devices and in the cloud…The use of digital currencies such as bitcoin,

while not yet mainstream, is growing

beyond the early enthusiasts. We expect

this growth to continue and allowing people to use bitcoin to purchase our

products and services now allows us to be at

the front edge of that trend[2].”

Both spokesmen acknowledged the practical usage of Bitcoin, and are extremely positive about the coin’s future development. While crypto currency payment was not mainstream in 2014, it is becoming increasingly popular in 2020.

Why Cryptocurrency is

Becoming More Widely Accepted

Nowadays, more than 1/3 of U.S. small and medium-sized businesses accept cryptocurrency as payment for goods and services, with younger companies up to twice as likely to trade in crypto[3]. Compared to the legacy payment systems, cryptocurrency as a means of payment has a lot of advantages.

●

More Economical

The average credit card processing fees range from 1.7% to 3.5% per transaction[4]. Moreover, it usually takes banks a few working days to process transactions.

However, without middlemen, crypto payment saves merchants up to 5% per transaction[5]. In addition, as cryptos are borderless, merchants can access a global pool of customers without foreign transaction fees. Crypto.com, for example, charges only a 0.5% settlement fee which is waivable for the first 6 months. Besides lower fees, crypto transactions are faster since they can be completed within seconds.

●

More Secure

Banks are susceptible to frauds such as identity theft. According to the US Federal Trade Commission, the number of identity theft reports doubled in 2019.

Cryptocurrency, however, does not have this problem. Thanks to its decentralised nature, blockchain is tamper-proof, enabling fraud-resistant transactions. While hackers can figure out how to hack into your bank account, he cannot do anything to your crypto account.

●

More Private

Since banks and traditional payment processors are centralised, they have control of users’ private data such as name, age, net worth, assets, credit score and employers. These financial institutions can take down your account in a matter of seconds.

Crypto payment processors, on the contrary, only require basic information when you set up an account, such as your name and email address.

In summary, given the advantages of crypto payment, it is becoming more widely recognised and accepted.

How Does Crypto Payment Work?

From the previous content we have learnt that crypto transaction services are provided by “cryptocurrency payment processors”. Let’s now look at how crypto payment is settled.

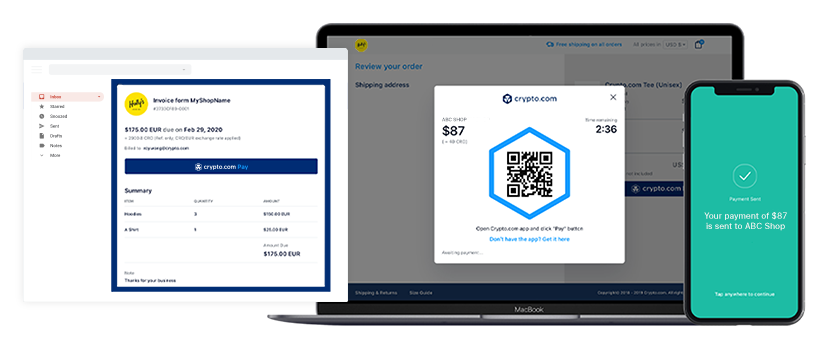

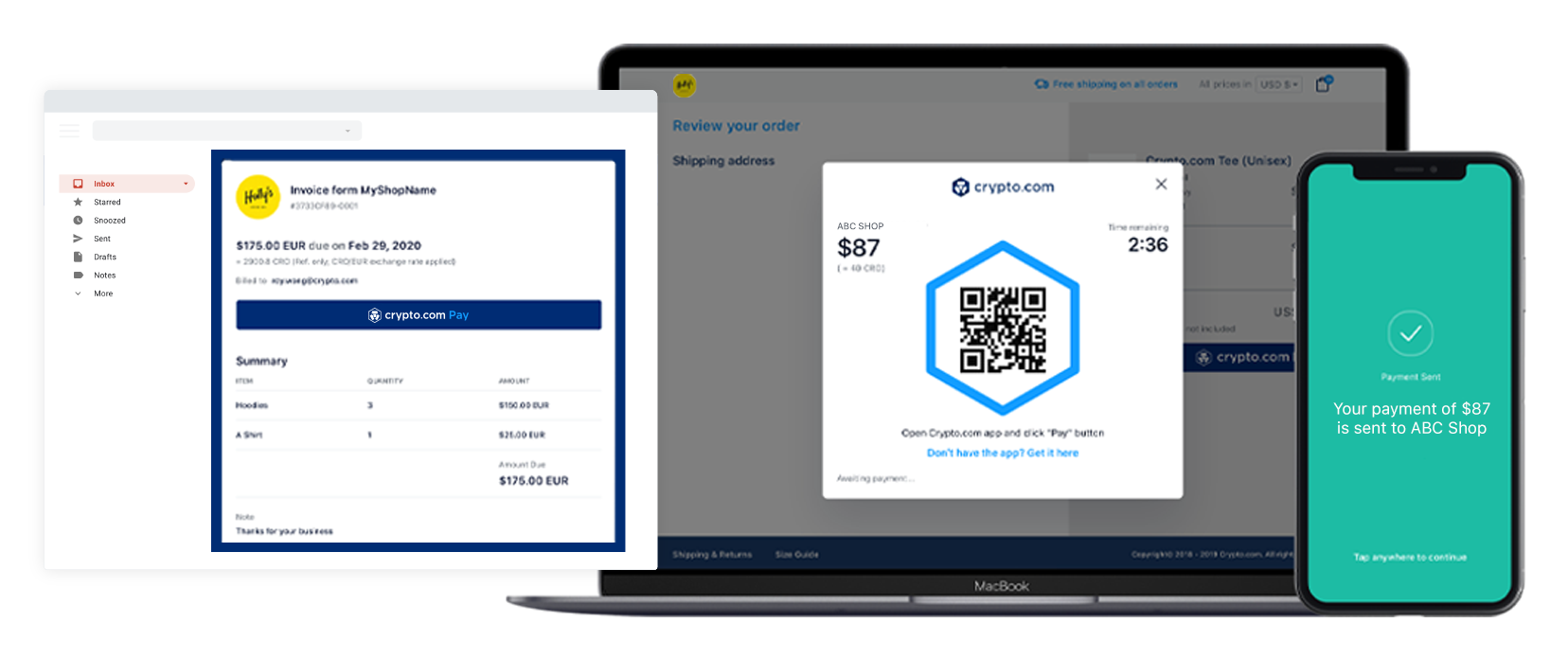

First thing first, crypto payment processors develop and maintain plugins for e-commerce platforms. Payment buttons are generated on the merchant dashboard and can be embedded anywhere on the merchant’s website. The stages involved in crypto payment are:

1. Preparation: Customers choose to pay in crypto on the checkout page of the online store.

2. Scan QR code: Customers scan QR code to initiate the payment.

3. Invoice and Payment: Customers receive an invoice generated by the merchant and pay it with crypto of their choice.

4. Conversion: Merchants receive payment instantly in fiat currency in their business accounts.

5. Transfer: Crypto payment processors transfer fiat funds received in merchants’ business accounts to their bank accounts.

Crypto checkout plugins help merchants keep up with the new trend in the payment industry. We have noticed that there are concerns from merchants when it comes to considering whether to receive crypto payments. Here, we have the most commonly asked questions answered.

●

Crypto-Fiat Exchange Rate

Merchants are able to accept cryptocurrencies without price fluctuation. Crypto payment processors will guarantee the fiat amount to be credited to merchants’ business accounts.

●

Time Required for Fiat Currency to be Deposited to Merchants’ Bank

Accounts

While you receive crypto instantly, the settlement date for fiat currency is usually T+2.

●

Fees Associated with Merchant Accounts

On average there would be a 1% transaction fee. However, some companies like Crypto.com charge no transaction fee or setup fee. Settlement fee is waived for the first 6 months, and after that, a 0.5% fee will be applicable when you send funds to your bank account.

Concluding Remarks

Undoubtedly, cryptocurrency payment is becoming popular. Merchants at OpenCart can now access to crypto-savvy customer base with a simple e-commerce platform plug-in or a few lines of codes added to your online store.

We know the biggest concern would be security, and we always choose the best for you. Crypto.com, for instance, is the first cryptocurrency company that achieves Cryptocurrency Security Standard (CCSS) Level 3 and PCI:DSS Level 1 compliance. The company assures you that safety and security are of the utmost importance.

Click here to apply for a Crypto.com Merchant Account, and here to learn more about Crypto.com Pay.

[1] Szoldra, P. (2013, November 21). A Cyprus

University Is First In The World To Accept Bitcoin For Tuition. Business Insider. https://www.businessinsider.com/cyprus-university-bitcoin-tuition-2013-11

[2] Tilley, A. (2014, December 11). Microsoft

Begins Accepting Bitcoin For Purchasing Digital Goods. Forbes. https://www.forbes.com/sites/aarontilley/2014/12/11/microsoft-begins-accepting-bitcoin-for-purchasing-digital-goods/#50bab1e34a84

[3] Business Wire. (2020, January 15). HSB Survey

Finds One-Third of Small Businesses Accept Cryptocurrency. https://www.businesswire.com/news/home/20200115005482/en/HSB-Survey-Finds-One-Third-Small-Businesses-Accept

[4] Prakash, P. (2020, March 19). Credit Card

Processing Fees: The Complete Guide. Fundera.

https://www.fundera.com/blog/credit-card-processing-fees

[5] DeVivo,

M. Why and How to Accept Cryptocurrency on Your Website. Single Grain. https://www.singlegrain.com/blockchain/why-and-how-to-accept-cryptocurrency-on-your-website/

Login and write down your comment.

Login my OpenCart Account