As Middle East advances its digital transformation through mandatory e-invoicing regulations, businesses face a critical decision: selecting the right KSA E-Invoice Software. With ZATCA's Phase 2 requirements now in effect, choosing software that ensures compliance while streamlining operations has become essential. This guide explores the key criteria businesses should consider when evaluating e-invoicing solutions, from technical capabilities and local support to integration features and scalability, helping you make an informed decision for your organization's success.

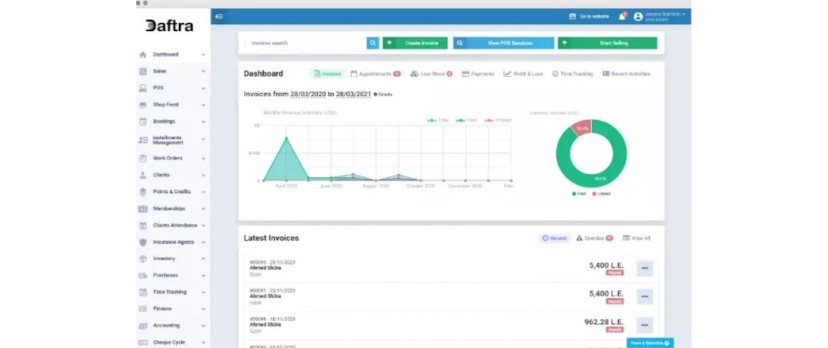

Daftra is A Trusted E-Invoicing Solution for Saudi Businesses

Daftra stands out as a leading Middle East E-Invoice Software, specifically designed to meet the unique needs of Saudi businesses:

• Full ZATCA Compliance: Certified for both Phase 1 and Phase 2 requirements, with automatic QR code generation, XML files, and real-time integration with ZATCA's systems

• Native Arabic Support: Built-in Arabic language interface with RTL design, pre-configured Saudi VAT rates, and support for both simplified and standard tax invoices

• Comprehensive ERP Platform: Beyond e-invoicing, Daftra includes integrated inventory management, CRM, POS systems, and financial reporting tailored to Saudi accounting standards

• User-Friendly Implementation: Quick setup process with guided onboarding, intuitive dashboard requiring minimal training, and 24/7 Arabic customer support

• Scalable Cloud Solution: Accessible from anywhere with mobile-responsive design, suitable for businesses of all sizes from startups to enterprises, with flexible pricing plans

• Security and Reliability: Bank-level encryption, automatic daily backups, and 99.9% uptime guarantee ensuring business continuity and data protection

With its deep understanding of Saudi business requirements and commitment to continuous updates aligned with regulatory changes, Daftra provides a reliable, all-in-one solution that grows with your business while ensuring complete compliance with Saudi e-invoicing regulations.

Why Choosing the Right E-Invoicing Software Matters in Middle East

With e-invoicing now mandatory in middle East under ZATCA regulations, selecting the right software isn’t just about convenience—it’s about legal compliance and business efficiency. The best software can help you avoid penalties, streamline your accounting process, and provide a competitive edge. On the other hand, choosing the wrong tool can lead to technical complications, non-compliance risks, and time-consuming manual work.

Saudi businesses need software that meets the unique requirements of local regulations while also offering an intuitive user experience. From real-time invoice generation to secure data handling, your software must support every part of your financial workflow.

Key Criteria for Selecting the Best E-Invoicing Software in Middle East

Choosing an e-invoicing solution should be based on several critical factors that ensure compliance, ease of use, and long-term scalability. Here are the top considerations:

1. Full Compliance with ZATCA Regulations

The most important factor is full adherence to ZATCA’s technical and legal standards. This includes:

Phase 1: Generating e-invoices with required fields and digital signatures.

Phase 2: Integration with ZATCA’s system to share invoices in real-time.

Support for QR codes, UUIDs, and structured XML formats.

Automated VAT calculations and invoice archiving.

Non-compliance can result in heavy fines or business interruptions, so certification and government approval are essential.

2. Arabic Language Support and RTL Interface

Since middle East is an Arabic-speaking country, your software must support full Arabic language functionality, including a right-to-left (RTL) user interface. This improves usability for local staff and ensures smoother adoption across your organization.

A bilingual interface (Arabic and English) is even better, as it accommodates teams with diverse language preferences.

3. Cloud-Based Accessibility and Data Backup

Modern e-invoicing software should be cloud-based, allowing you to:

Access invoices from any device, anywhere.

Back up data automatically.

Avoid losing crucial financial information in the event of system crashes.

Cloud access also supports remote teams, accountants, or auditors who need to access records without being on-site.

4. Ease of Use and User Interface Design

A complicated or outdated user interface can discourage employees from using the system correctly. The best e-invoicing tools are:

Easy to navigate

Require minimal training

Offer tutorials or in-app guidance

Intuitive dashboards, drag-and-drop features, and smart invoice generation save your team valuable time.

5. Scalability and Customization Options

As your business grows, your invoicing needs may change. A scalable software solution should allow:

Adding multiple users or branches

Creating custom invoice templates

Setting user roles and permissions

Look for solutions that can grow with your company instead of forcing you to migrate to a new system later.

6. Integration with Other Business Tools

Your e-invoicing software should integrate smoothly with:

Accounting platforms

Inventory management systems

Payment gateways

ERP tools

These integrations eliminate double entry, reduce errors, and create a streamlined workflow from invoice generation to payment collection.

7. High-Level Security Standards

Security is a major concern when dealing with financial data. A good e-invoicing software must include:

End-to-end encryption

Two-factor authentication (2FA)

Role-based access control

Data encryption in storage and transit

Regular backups and disaster recovery plans

This helps protect your business from cyberattacks and ensures data integrity.

8. Reliable Customer Support

Tech issues can happen anytime, and when they do, responsive support is crucial. The ideal software vendor offers:

24/7 customer support in Arabic and English

Live chat or hotline options

A knowledge base or help center

Quick resolution times

Good support ensures you never miss compliance deadlines due to technical glitches.

9. Cost and Value for Money

Pricing should reflect the value offered. Some software may seem affordable upfront but charge extra for critical features like ZATCA integration or additional users. Evaluate:

Monthly vs. annual plans

Free trials or demos

Inclusions like updates and support

Hidden fees

Choose a solution that gives you full value for your investment.

10. Real-Time Updates and Regulation Tracking

Saudi tax regulations are evolving. Your software should provide:

Real-time updates for new ZATCA rules

Automatic software updates

Alerts about regulatory changes

This keeps your business compliant without manual research or third-party involvement.

Login and write down your comment.

Login my OpenCart Account